Personal Finance

The homevoter hypothesis states that NIMBY municipal policies result from homeowners being a dominant majority of voters, who will tend to vote for policies that make homes more expensive. The majority of Americans are homeowners. Then of course, more older people are homeowners than young people, and of course, “old people vote, young people don’t.”

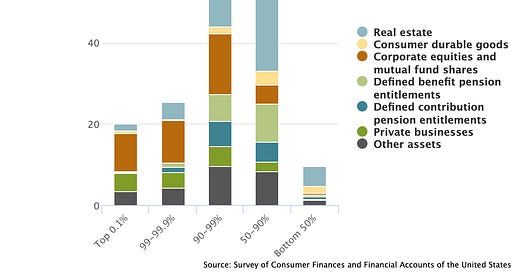

American homeowners tend to care a lot about the value of their home, because it represents a huge portion of their wealth. For all but the wealthiest top 10% of Americans, real estate is the largest share of their wealth of any asset class. For the bottom 50%, real estate represents fully half of their net worth.

Poorer people think that home ownership is the path to wealth. Rich people realize that equities are the far superior investment. Even in the ridiculous housing shortage that NIMBY policies have manufactured since the 1970s, stock appreciation has still out-performed real estate appreciation.

But homeownership is the American Dream, right? Perhaps even the American religion, depending who you ask! “Renting is just throwing money away,” right? “You’ve got to be building equity!” Well, if you were putting those downpayment savings into a boring old stock index fund instead of leaving it liquid in a savings account, it would be growing during the entire duration of the period you’re accumulating those savings. Then when you buy the house, the mortgage lasts 30 years, which by the age you can afford a downpayment these days, 30 years is most of the rest of your life. All the while, and in perpetuity even after the mortgage is paid off, you have to pay property taxes and maintenance costs. Meanwhile, you could be renting an equivalent place for cheaper, investing the difference in index funds, and coming out ahead. If renting instead of buying incentivizes you to choose a place closer to work and reduce your commute, you’ll save even more.

Just like people vastly under-estimate the cost of car ownership, people vastly under-estimate the actual costs of home ownership. They say, “look, the mortgage is the same as my rent, I might as well be building equity!” Then, unknowingly, they over-commit themselves to a financial black hole, dealing with this and that maintenance expense for the rest of their lives. Just look at any rent vs buy calculator - New York Times, Nerdwallet, pick your poison. Everybody’s saying buying is stupid these days. Save money by renting, and invest the difference in a boring old stock index fund. Buying is only advantageous if you know you’re so uncontentious and financially irresponsible that you need a mortgage to force yourself to save.

Older people often tell younger adults like myself to take advantage of the freedom of youth, saying, “once you have responsibilities like kids and a mortgage it’s harder to _____.” So… paying a mortgage is a responsibility, but paying rent isn’t? Of course that’s ridiculous. The mortgage isn’t some newfound responsibility relative to paying rent, it’s just that owning and maintaining a building is a giant pain in the ass. Ever heard that quote from Fight Club? “The things you own end up owning you.” And for what? Less value per dollar invested, and more risk, but hey, people might judge you if you’re a renter past age 30, and we can’t have that!

So a bunch of people who may or may not be particularly financially literate are socially pressured into putting most of the money they’ve ever earned into a mediocre asset, and then in order to justify their investment, they vote to create a massive supply shortage so that their incredibly vulnerable, un-diversified investment does slightly less poorly relative to the incredibly lucrative alternative that is the American stock market.

This shortage causes rent inflation which disproportionately hurts the poorest people. While incomes have been going up across the board, incomes after rent have been rising for the rich while they fall for the poor. When people talk about the economy being bad right now when it is exceptionally great by nearly all measures, they’re really just talking about the housing shortage.

This shortage makes life worse for everybody, including homeowners. Sure, their one incredibly valuable asset has appreciated more than it would have with housing abundance, but even if they don’t have an empathetic bone in their body for the homeless, the increase of tents on sidewalks, property crime, and public psychotic breakdowns are unpleasant to be around. Even if you live in a leafy outer-ring suburb, “we don’t go downtown anymore” is a real diminishment of your ability to enjoy your place!

These negative qualities then make your city and metro area a less attractive place to move, diminishing regional economic growth, meaning fewer lucrative job opportunities for you, your family, and your friends; and a diminished arts and culture sector. Having your place be nice and desirable attracts people, and attracting more people makes your place more nice and desirable. It’s a great virtuous feedback loop. Unless you don’t build housing.

The housing shortage “benefits” the older homeowners, but then their children are priced out of living anywhere near them. And the banning of apartments and granny flats mean there are few options for older homeowners to downsize while staying close to their community, so older empty-nesters end up staying in over-sized homes with tons of empty bedrooms, while young people are having fewer kids than they want, because they can’t afford more bedrooms. This is happening while we’re staring down the barrel of the gun that is demographic collapse.

To top it all off, these higher home values literally don’t even benefit homeowners. The wealth exists entirely on paper, it’s an unrealized gain. They would only benefit from the housing shortage making their home more valuable if they sold their home, but then they’d still need to pay for a new place to live! Having scarcity in the housing market is only financially beneficial to you if you own multiple homes and are renting them out, but I’d bet the vast majority of that real estate wealth among the bottom 50% (and even the bottom 90%) is in people’s primary residences!

So people are socially pressured into investing in a poorly performing asset, and then out of fear of that investment not working out, they vote for policies that make their lives worse, only to enrich real estate investors. Then they claim that alternative policies would just enrich developers or landlords, even though landlords are the people most benefiting from the status quo of the shortage.

I don’t say this to make landlords out to be villainous masterminds who’ve engineered a housing shortage. That’s all on the homevoters. Like I said before, owning a building is a huge burden and responsibility. If something goes catastrophically wrong with a building, the owner is on the hook for expensive structural repairs, interminable agony with an insurance company, etc.. Catastrophic risk is the landlord’s problem— as a renter you get to just move away and wash your hands of the problem. Landlords only become villains when a crippling housing shortage gives them oligopoly power to charge exorbitant prices and treat tenants like shit without even bothering with maintenance. Housing abundance forces landlords to compete on quality and pricing in order to attract tenants.

Of course, “progressives” say we can’t build more abundant housing in cities either, because that might cause “gentrification.” Renters in shitty neighborhoods are so fatalistic about the possibility of ever achieving adequate housing supply, and so desperate to keep their rents down, that they’ve become convinced they might as well keep demand down by making sure their neighborhood remains shitty enough to keep people away. Any improvements are met with hostility, because improvements might make the neighborhood more appealing to richer people. (These renters are joined in the “progressive” nativist coalition by wealthy homevoters.)

Well, newsflash, the slightly-richer people who’ve been priced out of the nicer neighborhoods have to go somewhere, and no matter how hard you try to keep the neighborhood shitty, people are going to choose a shitty neighborhood with a good location over super-commuting. Making a place nicer does not cause displacement, shortages cause displacement. Building more housing reduces displacement. Making places nicer is good. Building more housing is good. So we should make places nicer by building many, many units of nice new housing.

And all this is not even getting into all the stupidity at the level of municipal finance, where urban amenities like paved roads, water, sewer, policing, schools, libraries, traffic signals, etc., are fundamentally too expensive to be paid for by the property tax revenues of low density single family homes. This leads to suburbs declining as long-term maintenance obligations get triaged, because they are fundamentally fiscally unsustainable. Most middle class families move out by the time the schools start going downhill, as long as they can afford to. Then only poor people are left holding the bag by the time a water system fails, like in Flint, Michigan or Jackson, Mississippi.

I’m just so tired of all the stupidity. Let’s build housing. Let’s stop being fatalistic about the economy and whining about “capitalism” being the source of all our problems. Let’s stop wasting money on paving stupid expensive cul-de-sacs we can’t afford, far away from jobs so that people are forced into commutes they can’t afford. Lets focus our resources on building places that are actually fiscally sustainable, help people access good paying jobs, and enable people to build community wealth that will endure for generations to come.

Please build more dense housing. But please save wilderness and wildlife habitat. Also, please make valuable land, like waterfront, public land with nice walking/bike paths.

Rent vs Buy depends on the circumstance. Buying just a few years ago would have been a huge win.

There are a lot of tax incentives related to owning a home versus other investments. And I don't just mean taxes paid, its easier to shield owner owned real estate from lots of means tested stuff (college financial aid, medicaid, etc).

There are also some places where it's not practical to rent. Looking at the rental options in my town they are pretty abysmal. If you want a nice house in this location, buying is your only option.

If your single I get renting but if you've got a big family buying usually (not right now) makes sense.